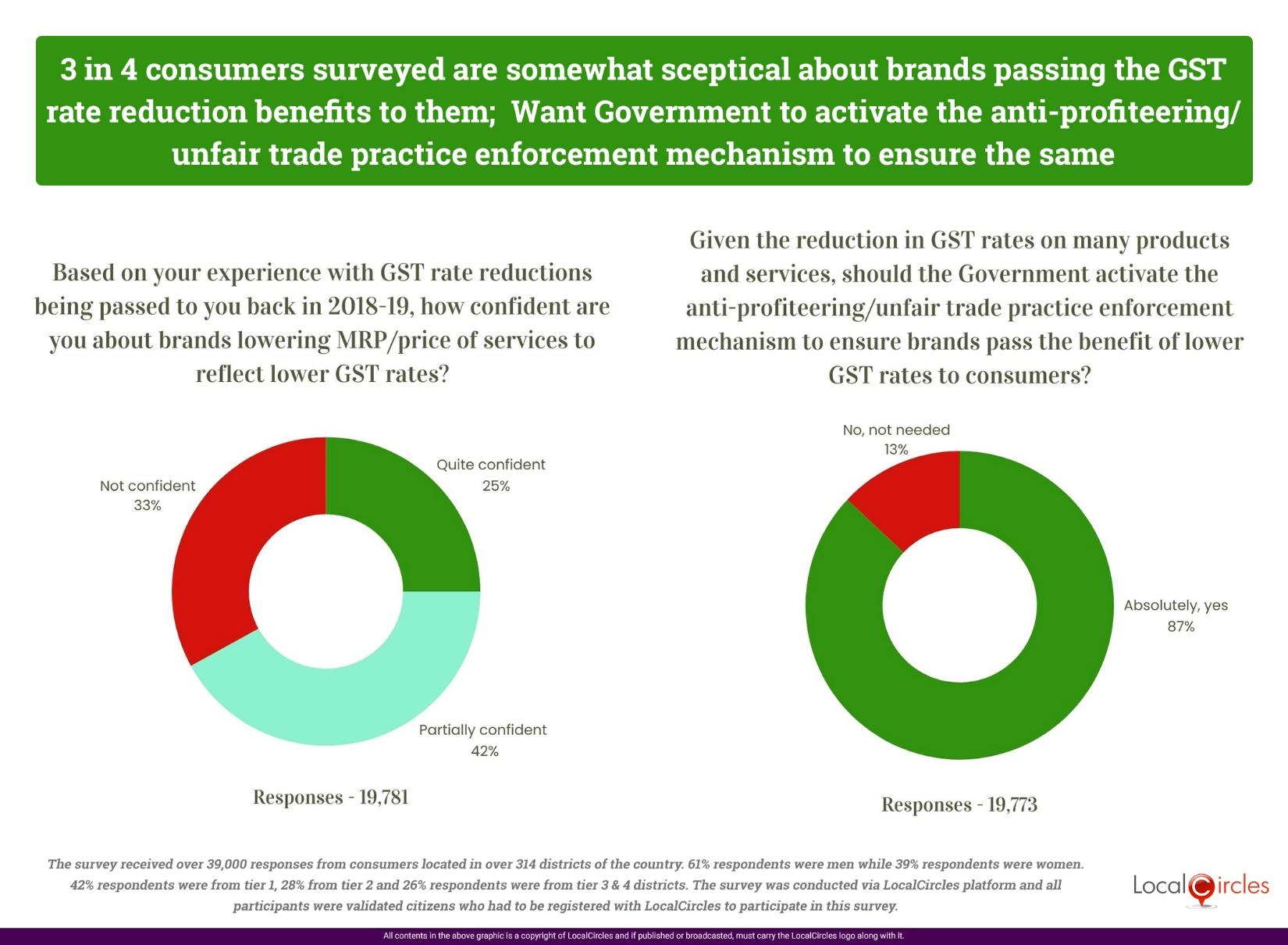

3 in 4 consumers surveyed are somewhat sceptical about brands passing the GST rate reduction benefits to them; Want Government to activate the anti-profiteering/unfair trade practice enforcement mechanism to ensure the same

- ● 87% of consumers surveyed want Government to activate the anti-profiteering / unfair trade practice enforcement mechanism

Sep 9, 2025, New Delhi: On the heels of the reforms in Goods and Services Tax (GST), which will see considerable reduction in the tax rates of several products from September 22, the question now worrying the administrators is whether consumers will be able to reap the intended benefits. This worry has raised talks of the possibilities of the central government bringing back anti-profiteering provisions for a limited period of around 2 years.

Under the reformed GST regime (the GST 2.0 framework), most goods and services will now be charged at the rates of 5% and 18%, with only so-called de-merit goods and sin products being charged at 40%. Many products have moved from 18% or 12% to a rate of 5%. And some have moved from 28% to 18%.

The proposal to set up the National Anti-Profiteering Authority (NAA) to regulate unfair profiteering practices by companies, was first introduced in 2017. It was established in November 2017 under Section 171 of the CGST Act to ensure that reductions in GST rates or benefits from input tax credits were passed on to consumers. It worked alongside the Directorate General of Anti-Profiteering (DGAP) to investigate complaints filed against various businesses.

In December 2022, the NAA was dissolved, and its functions were transferred to the Competition Commission of India (CCI). However, the CCI—tasked with anti-trust regulation—struggled with the new role, citing a lack of expertise and institutional synergy. By October 2024, the backlog and concerns about effectiveness prompted the GST Council to redirect anti-profiteering cases to the GST Appellate Tribunal (GSTAT), with a sunset clause invoked in April 2025 for new complaints.

As of September 2025, enforcement is handled by GSTAT, and discussions are now underway about reviving a dedicated anti-profiteering mechanism under the GST 2.0 framework — potentially with improved methodologies, faster resolution, and better compliance focus.

LocalCircles has worked closely with NAA and it helped the authority launch the “Anti-Profiteering” online community. This community, with tens of thousands of consumers, enabled early public reporting and awareness of profiteering cases, serving as a grassroots alert system to supplement formal complaint channels.

In view of the new slab changes in GST, which are intended to improve tax collection, help businesses and most importantly benefit the consumers, LocalCircles has conducted a survey to find out whether consumers are confident about brands lowering MRP/ price of services to reflect lower GST rates. If not, do they favour having a more active anti-profiteering authority which will ensure that consumers don’t lose out. The survey received over 39,000 responses from consumers located in over 314 districts of the country. 61% respondents were men while 39% respondents were women. 42% respondents were from tier 1, 28% from tier 2 and 26% respondents were from tier 3 & 4 districts.

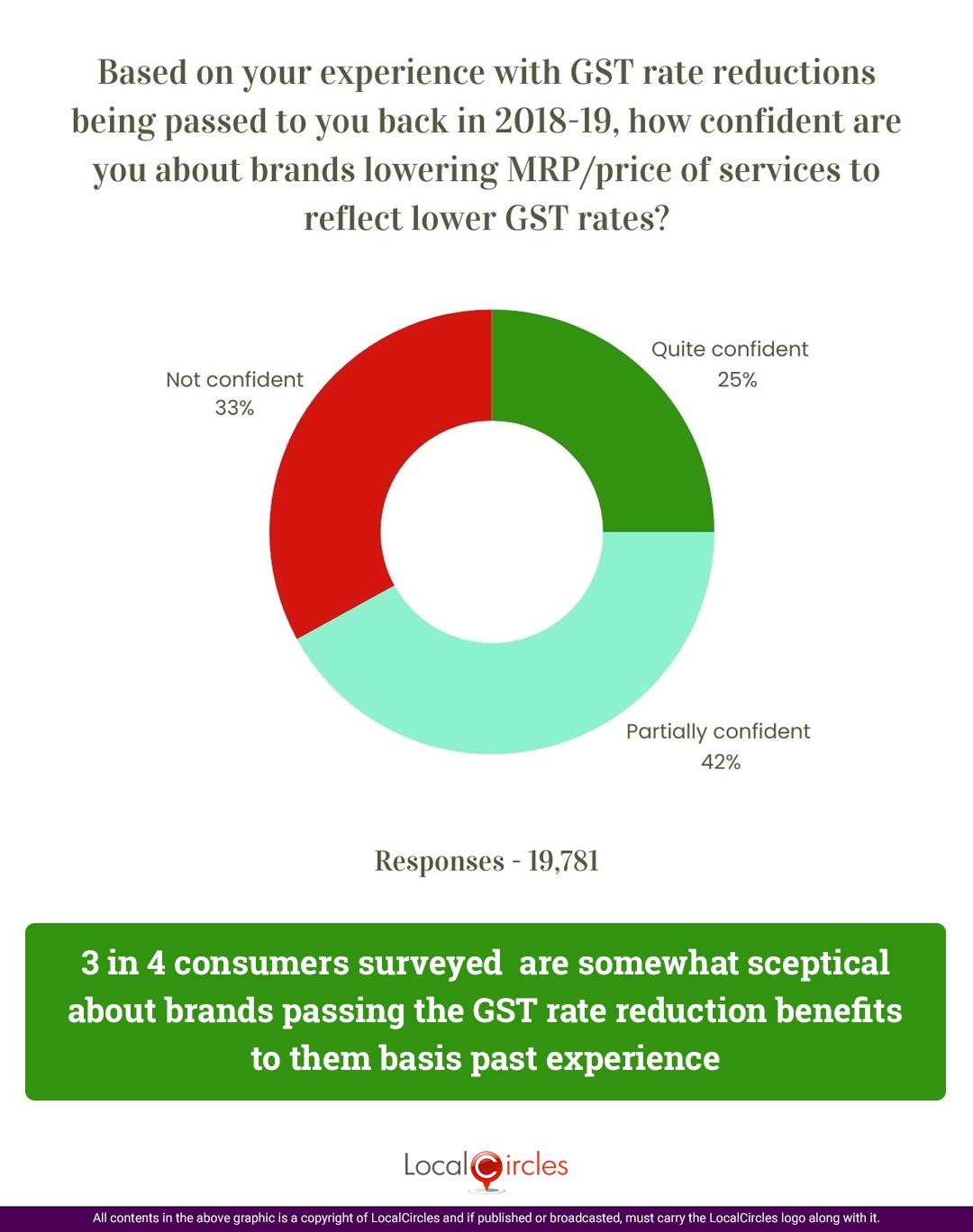

3 in 4 consumers surveyed are somewhat sceptical about brands passing the GST rate reduction benefits to them based on past experiences

The survey first asked consumers, “Based on your experience with GST rate reduction being passed on to you back in 2018-19, how confident are you about brands lowering MRP/ price of services to reflect lower GST rates?” Out of 19,777 consumers who responded to the question 25% indicated that they are “quite confident”; 42% of respondents stated that they are “partially confident”; 33% of respondents however stated that they are “Not confident”. To sum up, 3 in 4 consumers are somewhat sceptical about brands not passing the GST rate reduction benefits to them based on past experiences.

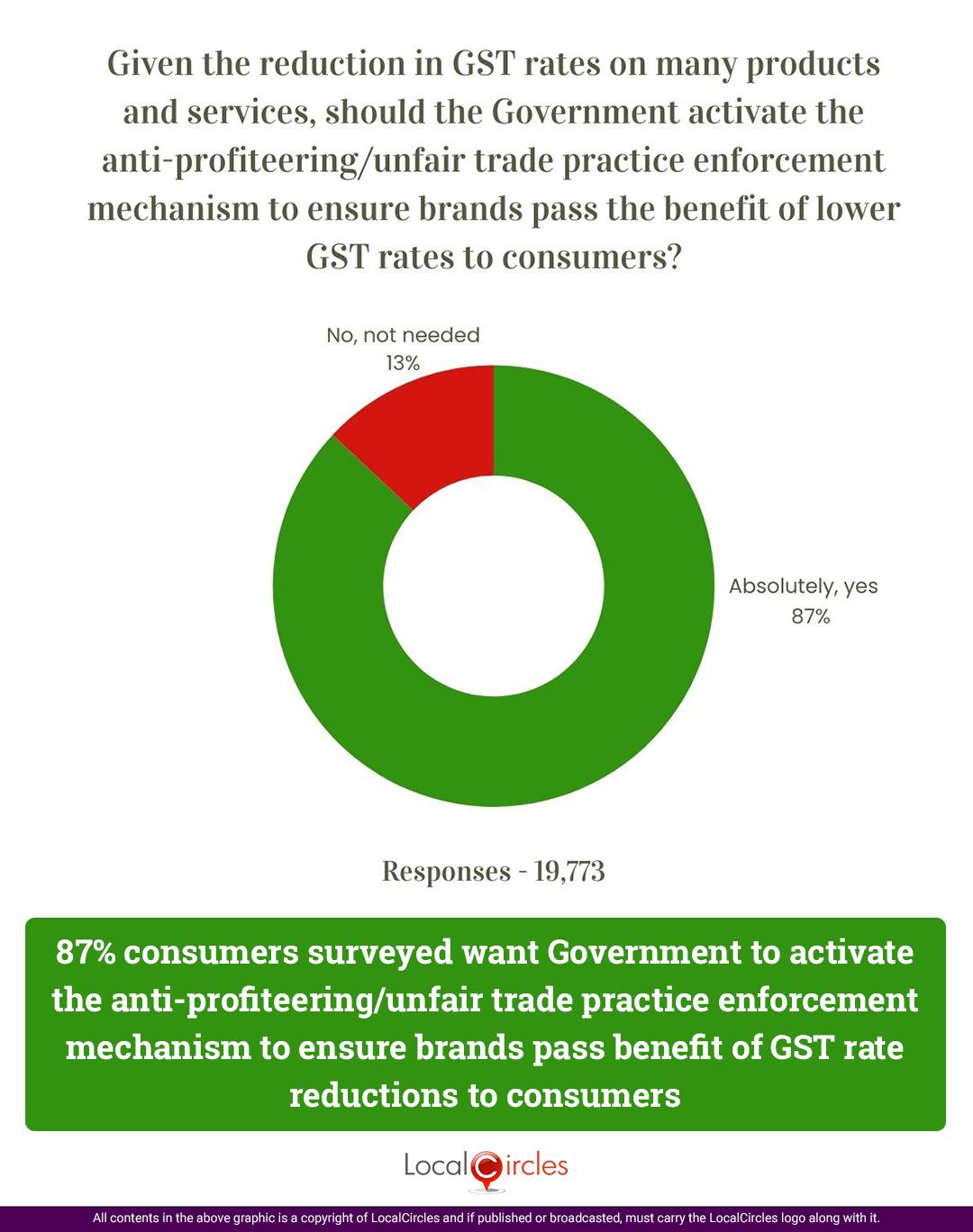

87% of consumers surveyed want Government to activate the anti-profiteering/unfair trade practice enforcement mechanism to ensure brands pass benefit of GST rate reductions to consumers

The survey next asked consumers, “Given the reduction in GST rates on many products and services, should the government activate the anti-profiteering/ unfair trade practice enforcement mechanism to ensure brands pass the benefits of lower GST rates to consumers?” Out of 19,773 consumers who responded to the question, 87% stated “absolutely, yes” the anti-profiteering authority should be reactivated while 13% of respondents stated “no, not needed”. In essence, 87% of consumers surveyed want Government to activate the anti-profiteering / unfair trade practice enforcement mechanism to ensure brands pass benefit of GST rate reductions to consumers.

In summary, a large number of consumers seem to share concerns that the businesses, including brands, may not pass on the benefits of lower GST slabs to them. 3 in 4 consumers are somewhat skeptical about brands not passing the GST rate reduction benefits to them based on past experiences. The scepticism about brands not passing the GST rate reduction benefits is further reflected in 87% of consumers surveyed wanting the Government to activate the anti-profiteering/ unfair trade practice enforcement mechanism to ensure brands pass benefit of GST rate reductions to consumers.

This demand of the consumers is not unjustified as in the past too, benefits to lowered tax rarely get reflected in the MRP of products. Instead, on the pretext of higher input costs, brands are known to retain the MRP or even raise it.

LocalCircles will escalate the findings of this survey with all the key stakeholders in the Government and the GST council so effective and easy consumer reporting can be enabled on the issue of brands and businesses passing GST benefits.

Survey Demographics

The survey received over 39,000 responses from consumers located in over 314 districts of the country. 61% respondents were men while 39% respondents were women. 42% respondents were from tier 1, 28% from tier 2 and 26% respondents were from tier 3 & 4 districts. The survey was conducted via LocalCircles platform, and all participants were validated citizens who had to be registered with LocalCircles to participate in this survey.

About LocalCircles

LocalCircles, India’s leading Community Social Media platform enables citizens and small businesses to escalate issues for policy and enforcement interventions and enables Government to make policies that are citizen and small business centric. LocalCircles is also India’s # 1 pollster on issues of governance, public and consumer interest. More about LocalCircles can be found on https://www.localcircles.com

For more queries - media@localcircles.com, +91-8585909866

All content in this report is a copyright of LocalCircles. Any reproduction or redistribution of the graphics or the data therein requires the LocalCircles logo to be carried along with it. In case any violation is observed LocalCircles reserves the right to take legal action.

Enter your email & mobile number and we will send you the instructions.

Note - The email can sometime gets delivered to the spam folder, so the instruction will be send to your mobile as well