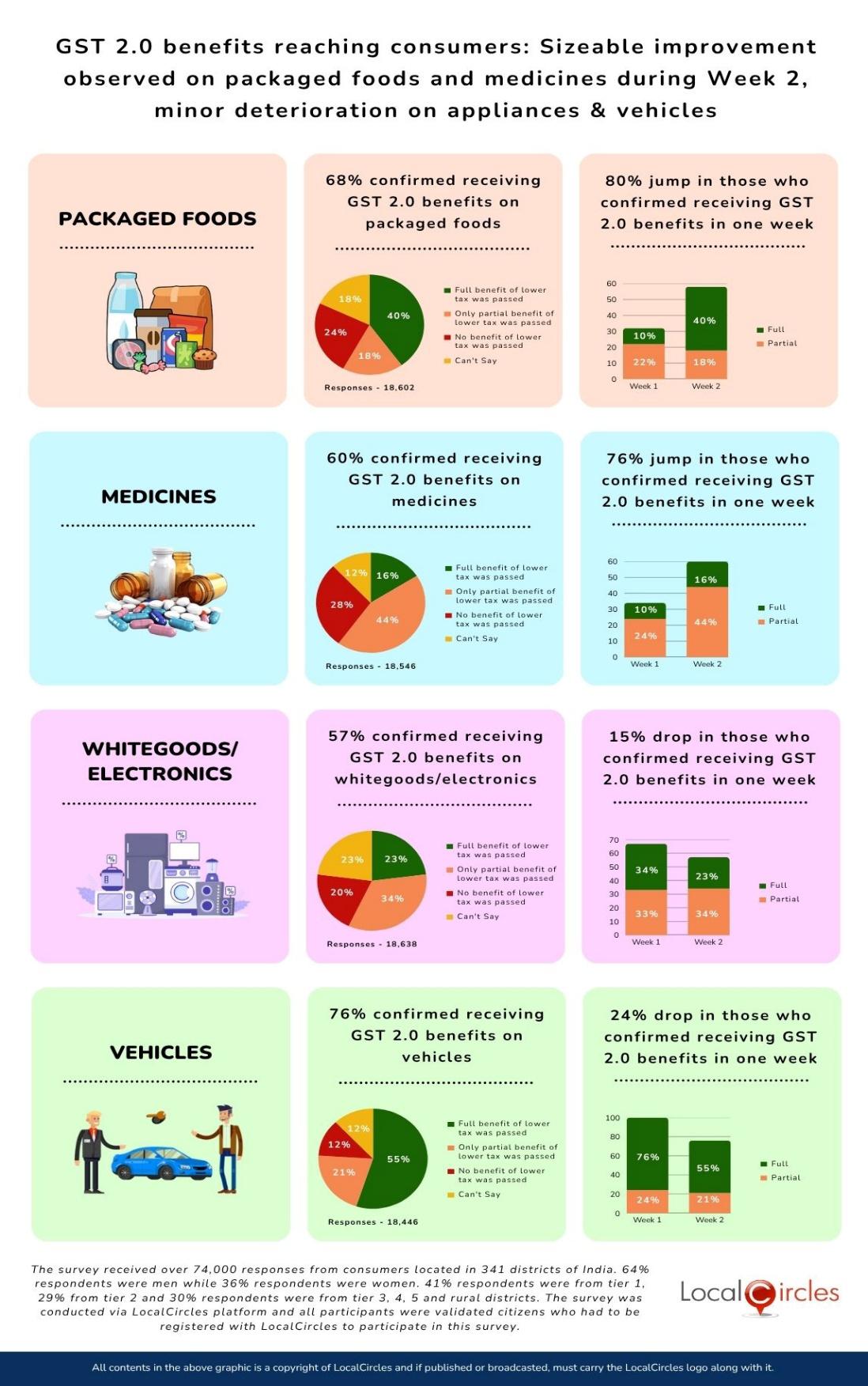

GST 2.0 benefits reaching consumers: Sizeable improvement observed on packaged foods and medicines during Week 2; minor deterioration on appliances & vehicles

Oct 6, 2025, New Delhi: Two weeks after Goods and Services Tax (GST) rates were lowered for around 80 goods and services, many consumers still are waiting for the full benefits as promised to them by the government.

Looking at some of the comments or observations on social media, consumers appear far from satisfied at the implementation at the market level. Ahead of the government announcement of the new GST rates, several fast-moving consumer goods (FMCG) companies, especially top rung companies, were reported to have been under pressures as buying from distributors took a hit while the trade slowed down their purchases during July-September quarter in anticipation of new stock with updated maximum retail prices (MRP).

The LocalCircles survey after the implementation of GST 2.0, which overhauled the rates to two-tier structure of 5% and 18%, while luxury and sin goods are now taxed at 40%, revealed that the full benefits are hardly reaching the consumers, except in the case of automobiles where 7 in 10 who bought a vehicle in the first week confirmed receiving full benefit of the revised GST rate while 2 in 10 confirmed receiving partial benefit. In other categories like packaged foods and medicines, only 1 in 10 consumers surveyed confirmed receiving full benefit of GST rate reduction while 2 in 10 received partial benefits. Things were slightly better in the case of appliances, white goods and consumer electronics with 3 in 10 consumers surveyed confirming receiving full benefit of GST rate reduction, while another 3 in 10 confirmed receiving partial benefit.

The slow pass through of benefits to consumers in part is reported to have been due to retailers’ reluctance to sell at lower prices without the brands or manufacturers agreeing to make up for their losses.

Given the consumer experience in the first week, LocalCircles has conducted a new survey in the second week after GST 2.0 rates came into effect to find out whether brands and other manufacturers are ensuring that the retailers are indeed passing on the benefits of the lower GST rate to consumers. The survey received over 74,000 responses from consumers located in 341 districts of India. 64% of respondents were men while 36% respondents were women. 41% of respondents were from tier 1, 29% from tier 2 and 30% respondents were from tier 3, 4, 5 and rural districts.

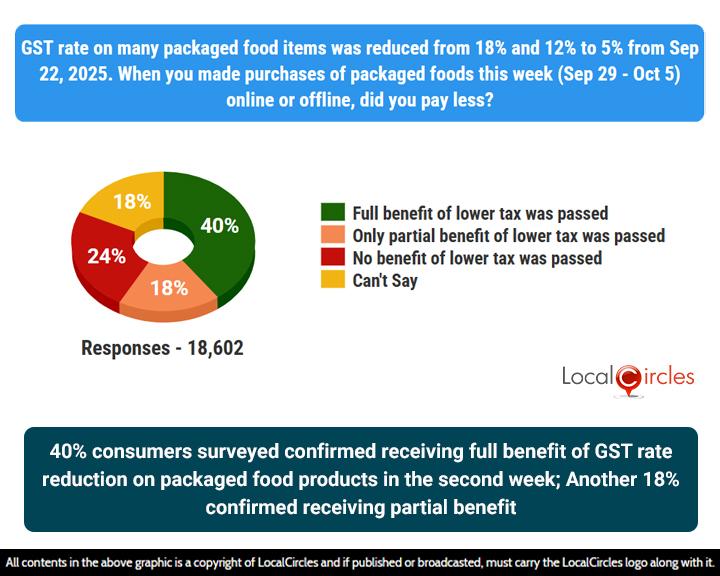

40% of consumers surveyed confirmed receiving full benefit of GST rate reduction on packaged food products in the second week; Another 18% confirmed receiving partial benefit

First looking at the packaged food sector, the survey asked consumers, “GST rate on many packaged food items was reduced from 18% and 12% to 5% from Sep 22, 2025. When you made purchases of packaged foods this week (Sep 29-Oct 5) online or offline, did you pay less?” Out of 18,602 consumers who responded to the question 40% indicated that “full benefit of lower tax was passed” to them; 18% of respondents indicated that “only partial benefit of lower tax was passed” to them; 24% of respondents indicated that “no benefit of lower tax” was passed to them; and 18% of respondents failed to give a clear answer. To sum up, 40% of consumers surveyed confirmed receiving full benefit of GST rate reduction on packaged food products in the second week; Another 18% confirmed receiving partial benefit.

80% increase observed in percentage of consumers who confirmed getting full or partial benefit of GST rate reduction on packaged food products; 300% jump in those who got full benefit

When comparing the benefits received by consumers of packaged food items since implementation of GST 2.0 from September 22, there is 80% increase observed in percentage of consumers who confirmed getting full or partial benefit of GST rate reduction. In fact, there is 300% jump in those who got full benefit. However, in total, 58% of consumers surveyed were able to get full or partial benefits so far as compared to 32% in the first week.

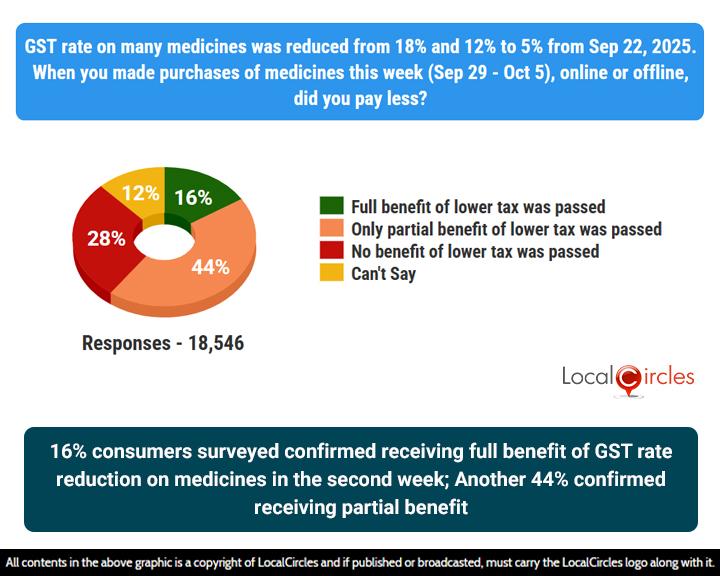

16% of consumers surveyed confirmed receiving full benefit of GST rate reduction on medicines in the second week; Another 44% confirmed to be receiving partial benefit

Life-saving and essential drugs for conditions like cancer, diabetes, and rare diseases are now exempt from GST (0% tax), and most other medicines, including traditional and homeopathic ones, have seen their GST rate reduced from 12% to a uniform 5%. The survey asked consumers, “GST rate on many medicines was reduced from 18% and 12% to 5% from Sep 22, 2025. When you made purchases of medicines this week (Sep 29- Oct 5), online or offline, did you pay less?” Out of 18,546 consumers who responded to the question, 16% stated that “full benefit of lower tax was passed”; 44% of respondents stated that “only partial benefit of lower tax was passed”; 28% of respondents stated that “no benefit of lower tax was passed”; and 12% of respondents did not give a clear answer. To sum up, 16% of consumers surveyed confirmed receiving full benefit of GST rate reduction on medicines in the second week; Another 44% confirmed to be receiving partial benefits.

76% increase observed in percentage of consumers who confirmed getting full or partial benefit of GST rate reduction on medicines; 60% jump in those who got full benefit

When comparing the benefits received by consumers who bought medicines, there is 76% increase observed in percentage of consumers who confirmed getting full or partial benefit of GST rate reduction. Among those who indicated having received full benefit there is 60% jump in the second week of tax reduction. Significantly, there is a sharp reduction in the percentage of consumers who claimed to have received no benefit from 62% in the first week to 28% now, however as against 4% who did not give a clear answer, the percentage of such consumers rose to 12% in the second week.

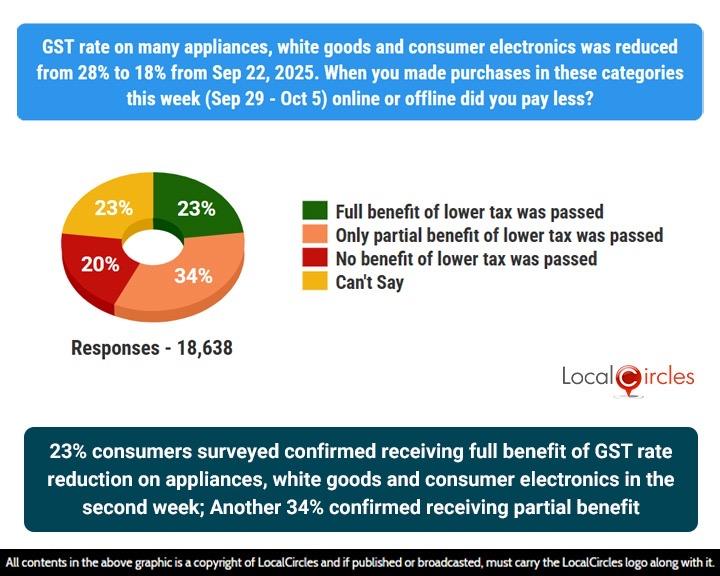

23% of consumers surveyed confirmed receiving full benefit of GST rate reduction on appliances, white goods and consumer electronics in the second week; Another 34% confirmed receiving partial benefit

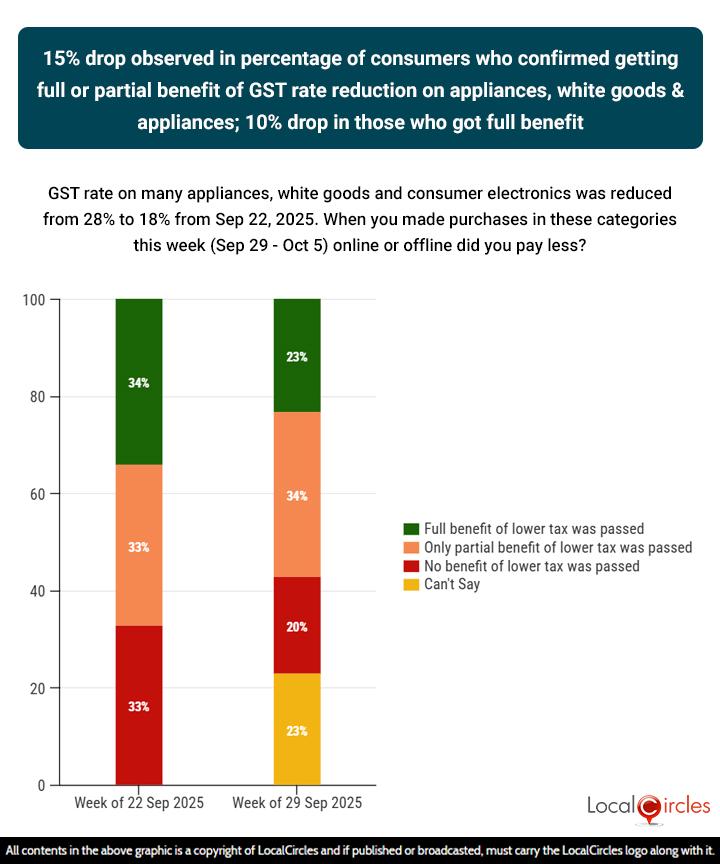

White goods and consumer electronics sales are reported to have seen a "decade-high" surge during the Navratri period, driven by a combination of pent-up demand and the positive impact of recent GST rate cuts. The survey asked consumers who bought white goods or consumer electronics, “GST rate on many appliances, white goods and consumer electronics was reduced from 28% to 18% from Sep 22, 2025. When you made purchases in these categories this week (Sep 29-Oct 5) online or offline did you pay less?” Out of 18,638 consumers who responded to the question 23% indicated that “full benefit of lower tax was passed”; 34% of respondents indicated that “only partial benefit of lower tax was passed”; 20% of respondents indicated that “no benefit of lower tax was passed”; 23% of respondents did not give a clear answer. To sum up, 23% of consumers surveyed confirmed receiving full benefit of GST rate reduction on appliances, white goods and consumer electronics in the second week; Another 34% of respondents confirmed receiving partial benefit.

15% drop observed in percentage of consumers who confirmed getting full or partial benefit of GST rate reduction on appliances, white goods & appliances; 10% drop in those who got full benefit

As compared to the first week, the new survey indicated that there was a 15% drop in percentage of consumers who confirmed getting full or partial benefit of GST rate reduction on appliances, white goods & appliances. There is 10% drop in the category of those who got full benefit, while 23% or almost one-fourth of those who responded to the question did not give a clear answer. This may be due to lack of transparency in the prices of white goods, electronics and appliances being sold in the market or online.

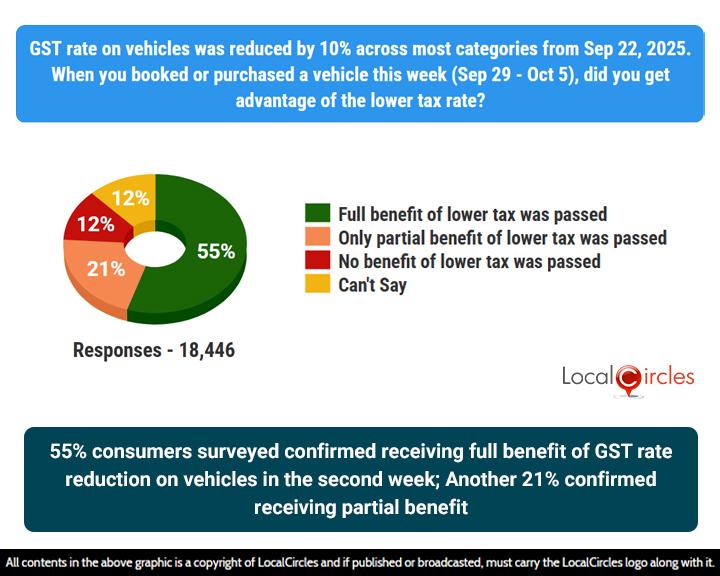

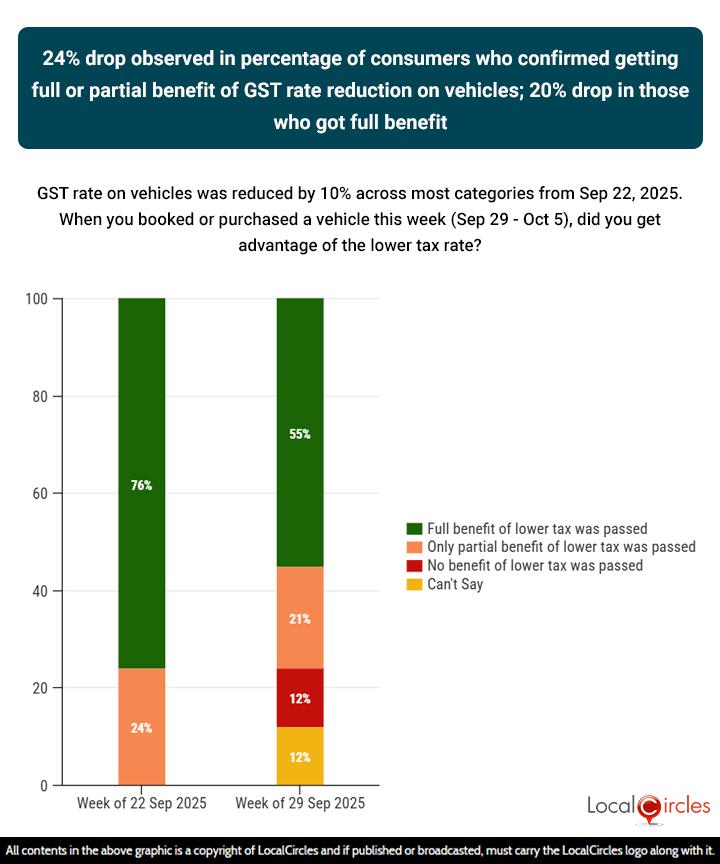

55% of consumers surveyed confirmed receiving full benefit of GST rate reduction on vehicles in the second week; Another 21% confirmed receiving partial benefit

Domestic passenger vehicles (PV) wholesales in September rose 5.4% year-on-year (Y-o-Y) to 381,437 units, driven by the cut in GST rate rationalization and the onset of the festival season, according to media reports. However, despite the enthusiasm of buyers, bottlenecks in deliveries ensured that dealers and thus most customers did not receive the vehicles. The survey asked consumers who had booked or bought vehicles, “GST rate on vehicles was reduced by 10% across most categories from Sep 22, 2025. When you booked or purchased a vehicle this week (Sep 29- Oct 5), did you get advantage of the lower tax rate?” Out of 18,446 consumers who responded to the question 55% stated “full benefit of lower tax was passed”; 21% of respondents stated “only partial benefit of lower tax was passed”; 12% of respondents stated “no benefit of lower tax was passed”; and 12% of respondents did not give a clear answer. To sum up, 55% of consumers surveyed confirmed receiving full benefits of GST rate reduction on vehicles in the second week, while another 21% confirmed receiving partial benefits.

24% drop observed in percentage of consumers who confirmed getting full or partial benefit of GST rate reduction on vehicles; 20% drop in those who got full benefit

When compared to the previous week, there is 24% drop in percentage of consumers who confirmed getting full or partial benefit of GST rate reduction on vehicles. More importantly, there is 20% drop in those who reported having got full benefit, while 12% of respondents stated that they had received no benefit of lower tax and 12% of respondents appear uncertain on the issue. One input that has been repeated received by LocalCircles is how some dealers, especially the two wheeler ones are offering freebies with vehicles instead of lowering the price per the new price list.

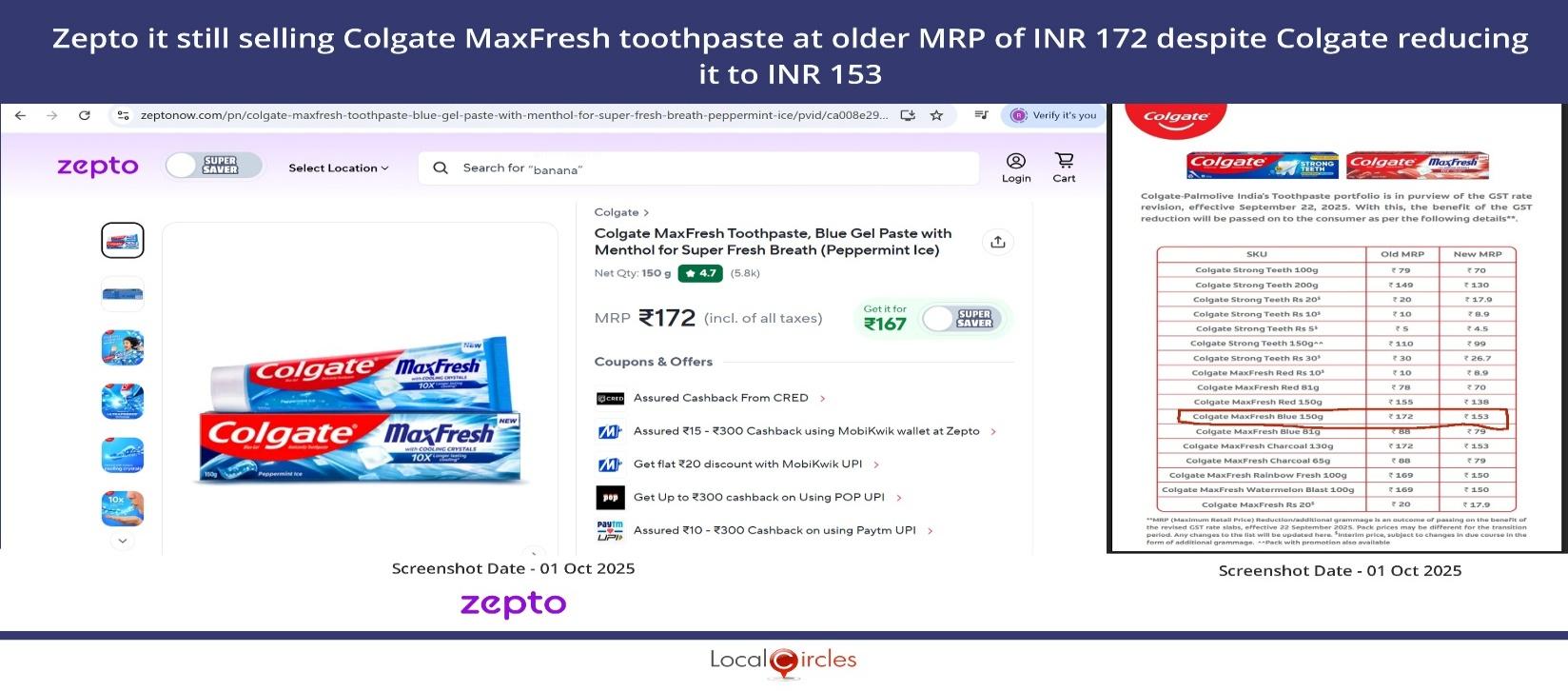

What the online and offline consumers are facing despite the cut in GST rates…

Here are 2 examples of how both online platforms and offline retailers are not passing on the benefits of reduced GST to consumers. In the first case, Zepto is still selling Colgate MaxFresh toothpaste on its online platform at older MRP on INR 172 despite Colgate reducing it to INR 153. Similarly, many offline retailers are not passing full benefit of the 7% reduction in GST to the consumers. The sale receipt shows that the medicine is being sold at old MRP of INR 519.70 though it should be sold for INR 483.30 or lower.

In summary, the study in the second week after the rollout of GST 2.0 shows that while there has been some improvement in the processed packaged food and medicines, there appears to have been some slide in the case of white goods, appliances and consumer electronics and vehicles.

The survey has revealed that 40% of consumers surveyed confirmed receiving full benefit of GST rate reduction on packaged food products in the second week; Another 18% confirmed receiving partial benefit. When compared to the first week, 80% increase has been observed in percentage of consumers who confirmed they got full or partial benefit of GST rate reduction on packaged food products. In fact, there is 300% jump in those who got full benefit. In the case of medicines, 16% of consumers surveyed confirmed receiving full benefit of GST rate reduction on medicines in the second week and 44% confirmed to have received partial benefits. When compared with the first week, 76% increase was observed in percentage of consumers who confirmed getting full or partial benefit of GST rate reduction on medicines. Interestingly, there is a 60% jump in those who got full benefit.

In the case of appliances, white goods and consumer electronics 23% of consumers surveyed confirmed receiving full benefit of GST rate reduction in the second week and another 34% confirmed receiving partial benefit. Compared to the first week, 15% drop has been observed in percentage of consumers who confirmed getting full or partial benefit of GST rate reduction, while 10% drop appears on those who got full benefit. In the case of vehicles, 55% of consumers surveyed confirmed receiving full benefit of GST rate reduction in the second week while another 21% confirmed receiving partial benefit. Compared to the first week, 24% drop has been observed in the percentage of consumers who confirmed getting full or partial benefit of GST rate reduction on vehicles. For reasons unknown, there is 20% drop in those who got full benefit.

LocalCircles will share this report with the government and urge the authorities to probe why benefits of GST rate reduction is not being passed on to all consumers across these fout segments i.e. packaged foods, medicines, appliances & electronics and vehicles. It is also clear that government will have to more proactively engage with FMCG and medicine brands to ensure that they and their distributors and stockists incentivise the retailers in ensuring that the customer receives the GST reduction benefit on immediate basis.

Survey Demographics

The survey received over 74,000 responses from consumers located in 341 districts of India. 64% respondents were men while 36% respondents were women. 41% of respondents were from tier 1, 29% from tier 2 and 30% respondents were from tier 3, 4, 5 and rural districts. The survey was conducted via LocalCircles platform, and all participants were validated citizens who had to be registered with LocalCircles to participate in this survey.

About LocalCircles

LocalCircles, India’s leading Community Social Media platform enables citizens and small businesses to escalate issues for policy and enforcement interventions and enables Government to make policies that are citizen and small business centric. LocalCircles is also India’s # 1 pollster on issues of governance, public and consumer interest. More about LocalCircles can be found on https://www.localcircles.com

For more queries - media@localcircles.com, +91-8585909866

All content in this report is a copyright of LocalCircles. Any reproduction or redistribution of the graphics or the data therein requires the LocalCircles logo to be carried along with it. In case any violation is observed LocalCircles reserves the right to take legal action.

Enter your email & mobile number and we will send you the instructions.

Note - The email can sometime gets delivered to the spam folder, so the instruction will be send to your mobile as well