Post week 1, less than 3 in 10 consumers surveyed confirmed retailers passing GST rate cut benefits on packaged food items and medicines; 9 in 10 who purchased vehicles got the benefits while 6 in 10 who bought white goods or electronics got them

- ● Nationwide survey received over 78,000 responses from over 27,000 consumers located across 332 districts of India on how GST rare reduction benefits reached them during the first week

Sep 29, 2025, New Delhi: The new Goods and Services Tax (GST) rates that came into effect earlier this month from September 22nd, the first day of Navratri, has impacted the prices of a whole range of goods of everyday use, essentialsto aspirational goods. These include consumption goods like biscuits, chocolates, snacks to essentials like school supplies, beauty products and medicines. Aspiration goods like large size TVs, air conditioners and vehicles too have been kept in the loop to boost consumer spending.

Thus, GST reform 2.0 impacts approximately 80 goods and services, to make them more affordable. Key changes include a 5% GST on items like gym memberships and certain medicines, and a 5% to Nil GST for food items like paneer and UHT milk. Aspiration goods such as cars, air conditioners, refrigerators and big TV screens have seen GST rate reduced from 28% to 18%. Overall, a wide range of goods and services of a person’s consumption basket have been touched as part of the reforms under GST 2.0.

The new GST structure, first announced by Finance Minister Nirmala Sitharaman earlier this month, seeks to boost consumer sentiments and thus spending while striving to boost industrial growth.

Changes, though slow, are already being noticed as products like sachets of shampoos and small pack of biscuits are no longer available in standard rate of INR 5 or INR 10, according to market reports. However, as small affordable packs remain vital for the industry - contributing 79% of shampoo sales, 64% in biscuits, 58% in chocolates, 44% in salty snacks, and 29% in toothpaste – they are now available at lower price points. The expectations are that the inconvenience of dealing with change and not rupees will be overcome through digital payments or else the consumers will not benefit.

The fact remains that most stores are still not displaying the changed MRPs due to old stock on shelves, while some have displayed a notice stating that the changed prices will be adjusted at the counter. However, many consumers have been raising issues on LocalCircles and other social media platforms about they not getting the benefit of lower GST rates at retail stores yet. In cases of online platforms as well, several complaints on social media have been raised by consumers.

One week after the implementation of the GST 2.0, LocalCircles through a comprehensive national survey has strived to get feedback from consumers whether they are actually able to buy the products – packaged food products, medicines, white goods, vehicles – with the revised lower GST rate. The survey received over 78,000 responses from over 27,000 consumers located in 332 districts of India. 66% respondents were men while 34% respondents were women. 43% of respondents were from tier 1, 24% from tier 2 and 33% respondents were from tier 3,4, 5 & rural districts.

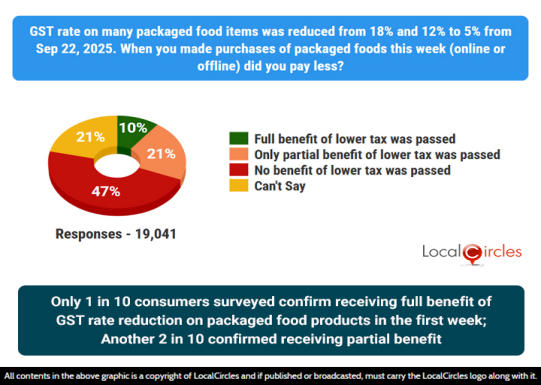

Only 1 in 10 consumers surveyed confirm receiving full benefit of GST rate reduction on packaged food products in the first week; Another 2 in 10 confirmed receiving partial benefit

As packaged food items are consumed by many families across the country, the survey asked consumers, “GST rate on many packaged food items was reduced from 18% to 5% from Sep 22, 2025. When you made purchases of packaged foods this week (online or offline) did you pay less?” Out of 19,041 consumers who responded to the question 10% indicated that “full benefit of lower tax was passed”; 21% of respondents indicated “only partial benefit of lower tax was passed”; 47% of respondents indicated "no benefit of lower tax was passed” and 21% of respondents did not give a clear answer. To sum up, only 1 in 10 consumers surveyed confirm receiving full benefit of GST rate reduction on packaged food products in the first week; Another 2 in 10 confirmed receiving partial benefit.

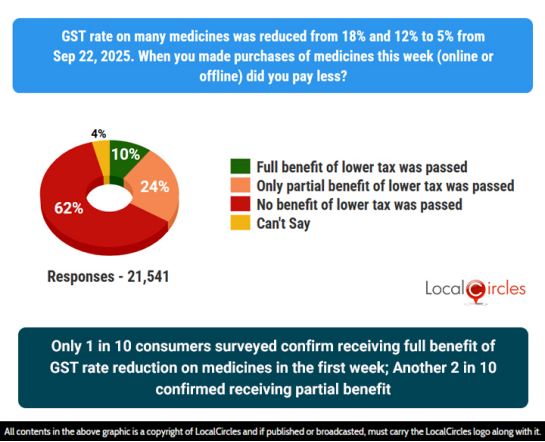

Only 1 in 10 consumers surveyed confirm receiving full benefit of GST rate reduction on medicines in the first week; Another 2 in 10 confirmed receiving partial benefit

Focusing on the next category of goods impacted by lower GST rate, the survey asked consumers, “GST rate on many medicines was reduced from 18% and 12% to 5% from Sep 22, 2025. When you made purchases of medicines this week (online or offline) did you pay less?” Out of 12,541 consumers who responded to the question only 10% indicated that “full benefit of lower tax was passed”; 24% of respondents indicated that “only partial benefit of lower tax was passed”; 62% of respondents indicated that “no benefit of lower tax was passed”; and 4% of respondents did not give a clear answer. To sum up, only 1 in 10 consumers surveyed confirm receiving full benefit of GST rate reduction on medicines in the first week; Another 2 in 10 confirmed receiving partial benefit.

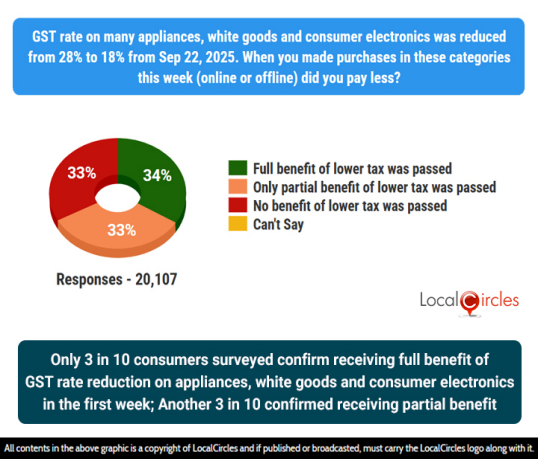

Only 3 in 10 consumers surveyed confirmed receiving full benefit of GST rate reduction on appliances, white goods and consumer electronics in the first week; Another 3 in 10 confirmed receiving partial benefit

With the festive season in full force, many consumers who were waiting for the new GST rates to come into force before making large purchases like large screen TV, air-conditioners, etc., would have made the purchases. The survey asked consumers, “GST rate on many appliances, white goods and consumer electronics was reduced from 28% to 18% from Sep 22, 2025. When you made purchases in these categories this week (online or offline) did you pay less?” Out of 20,107 consumers who responded to the question 34% indicated that “full benefit of lower tax was passed”; 33% of respondents indicated that “only partial benefit of lower tax was passed”; and 33% of respondents indicated that “no benefit of lower tax was passed” to them. To sum up, only 3 out of 10 consumers surveyed confirmed receiving full benefit of GST rate reduction on appliances, white goods and consumer electronics in the first week; Another 3 in 10 confirmed having received partial benefit.

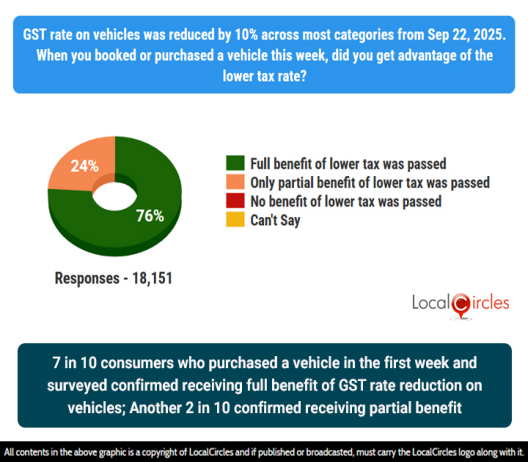

7 in 10 consumers who purchased a vehicle in the first week and surveyed confirmed receiving full benefit of GST rate reduction on vehicles; Another 2 in 10 consumers confirmed receiving partial benefit

Vehicles in most categories, particularly two wheelers and small cars, are beneficiaries of lower GST rates. The survey asked consumers, many of whom had been eagerly waiting for the lower GST rates to come into effect, “GST rate on vehicles was reduced by 10% across most categories from Sep 22, 2025. When you booked or purchased a vehicle this week, did you get advantage of the lower tax rate?” Out of 18,151 consumers who responded to the question 76% indicated that “full benefit of lower tax was passed” to them and 24% of respondents indicated that “only partial benefit of lower tax was passed” to them. In essence, 7 in 10 consumers who purchased a vehicle in the first week and surveyed confirmed receiving full benefit of GST rate reduction on vehicles; Another 2 in 10 consumers confirmed receiving partial benefit.

The government may have done its best to help boost consumer sentiments through simplification and lowering GST rates, yet both online and offline stores are still to pass on the full benefits to consumers. One of the issues consumers are repeatedly reporting when they ask their neighborhood retailers for lower GST rate products is to wait till products with revised MRP comes to their store. Most retailers say they haven’t received a directive and a discount commitment from the brand or the distributor and stockists and do not even have the revised price lists.

In summary, while the Government has brought in a very consumer centric GST 2.0, post the first week, the full benefits are hardly reaching the consumers, except in the case of automobiles where 7 in 10 who bought a vehicle this week confirmed receiving full benefit of the revised GST rate while 2 in 10 confirmed receiving partial benefit. In other categories like packaged foods and medicines, only 1 in 10 consumers surveyed confirmed receiving full benefit of GST rate reduction while 2 in 10 received partial benefits. Things seem to be slightly better in the case of appliances, white goods and consumer electronics with 3 in 10 consumers surveyed confirming receiving full benefit of GST rate reduction, while another 3 in 10 confirmed receiving partial benefit. In the case of FMCG products and medicines, clearly brands need to do a lot more so the last mile retailer knows what to do. Clearly doing this for such products is much more challenging as compared to automobiles or whitegoods given the hundreds of thousands of retail points across the country where such products are sold.

Given the consumer experience gathered by this survey on GST rate reduction benefits reaching them during the first week, LocalCircles will share this report with the government and urge the authorities to get FMCG and medicine brands to engage with their supply chain more effectively. The small retailer cannot bear the loss on their existing inventory and needs support of other supply chain entities with primary support coming from the brand to compensate for a small short term loss incurred by passing the benefit to the consumer. Having high consumer confidence is critical for GST 2.0 to get off to a solid start.

Survey Demographics

The survey received over 78,000 responses from over 27,000 consumers located in 332 districts of India. 66% respondents were men while 34% respondents were women. 43% of respondents were from tier 1, 24% from tier 2 and 33% respondents were from tier 3,4, 5 & rural districts. The survey was conducted via LocalCircles platform, and all participants were validated citizens who had to be registered with LocalCircles to participate in this survey.

About LocalCircles

LocalCircles, India’s leading Community Social Media platform enables citizens and small businesses to escalate issues for policy and enforcement interventions and enables Government to make policies that are citizen and small business centric. LocalCircles is also India’s # 1 pollster on issues of governance, public and consumer interest. More about LocalCircles can be found on https://www.localcircles.com

For more queries - media@localcircles.com, +91-8585909866

All content in this report is a copyright of LocalCircles. Any reproduction or redistribution of the graphics or the data therein requires the LocalCircles logo to be carried along with it. In case any violation is observed LocalCircles reserves the right to take legal action.

Enter your email & mobile number and we will send you the instructions.

Note - The email can sometime gets delivered to the spam folder, so the instruction will be send to your mobile as well