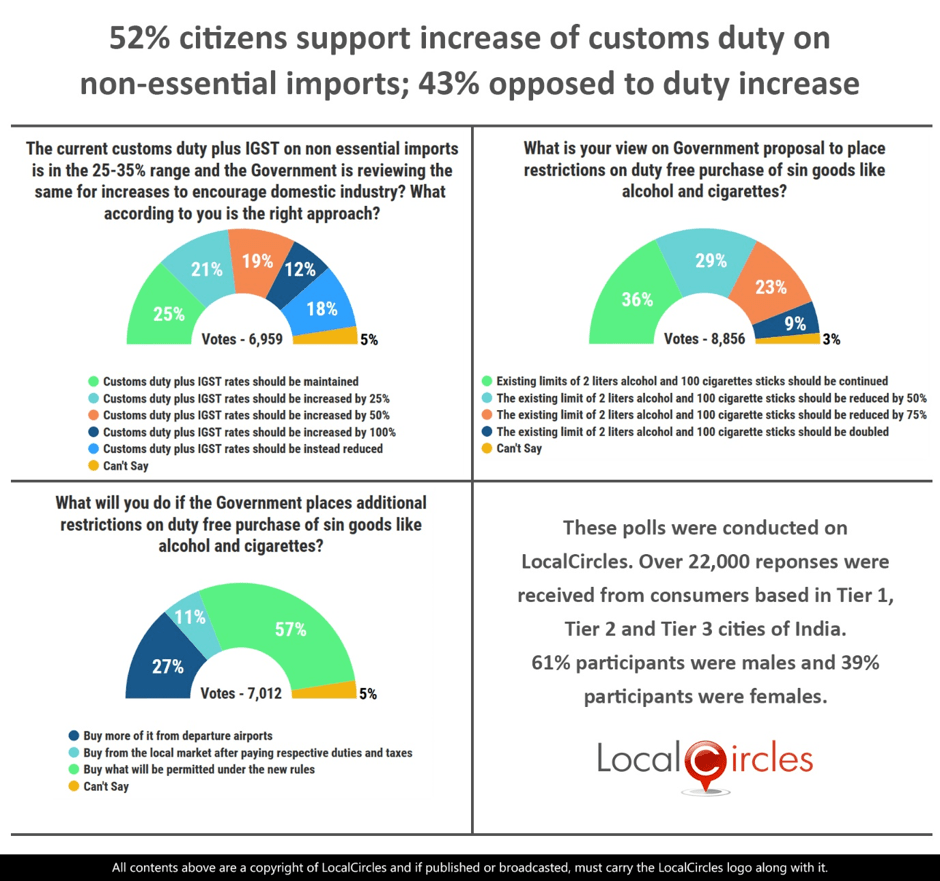

52% Indians support increase of customs duty on non-essential imports, 43% opposed to duty increase

- • 52% support the reduction of duty-free purchase quota for alcohol, cigarettes

- • 57% willing to comply if Govt reduces the limit on duty-free purchase

January 31, 2020, New Delhi: For as long as we can remember, owning a product made in a foreign country has been a matter of pride for most of us Indians. Countries like China have taken advantage of this fact and have flooded the Indian market with cheap and low-quality goods, especially toys and plastic goods which have often been found to be toxic.

The centre may be gearing up to place restrictions on the import of non-essential goods, a move primarily aimed at curbing imports of non-essential items such as toys, plastic goods, sports items and furniture, especially from China. LocalCircles conducted a 3-poll citizen pulse check to understand what people think about this move. The survey received more than 22,000 votes.

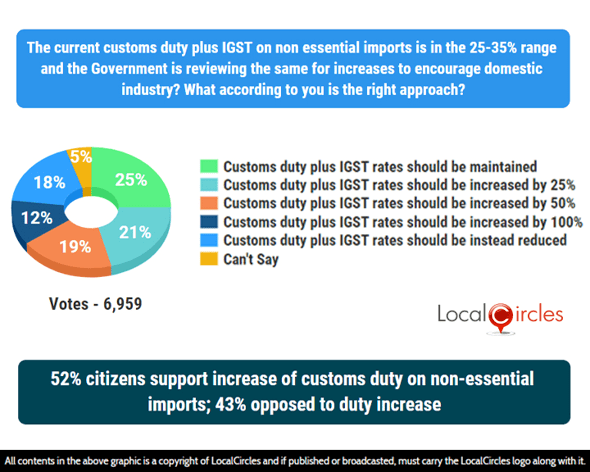

The current customs duty plus IGST on non-essential imports are in the 25-30% range and the Government is reviewing the same for an increase to encourage the domestic industry. In the first question, citizens were asked what is the right approach in their opinion. 26% said these customs duty plus IGST rates should be maintained while 21% said it should be increased by 25%. 19% said the rates should be increased by 50% and 12% said these rates should be doubled. 18% said customs duty plus IGST rates should instead be reduced.

52% citizens support increase of customs duty on non-essential imports; 43% opposed to duty increase

Non-essential imports just from China amount close to ₹4 trillion a year, creating a huge trade deficit. These imports have continuously been rising over the years giving tough and unfair competition to Indian businesses.

The second question asked citizens what is their view on the Government proposal to place restrictions on duty-free purchase of sin goods like alcohol and cigarettes. 36% said the existing limits of 2 litres alcohol and 100 cigarette sticks should be continued while 29% said this limit should be reduced by 50%. 23% said the existing limit should be reduced by 75% and 9% said this limit should be doubled.

52% citizens in support of reduction in limits of duty free purchase of sin goods; 45% citizens want it to be maintained or increased

Indian liquor imports for duty-free sales have been a very small percentage of the overall Indian imports every year, though the Government said it was trying to stop non-essential imports which will likely benefit domestic manufacturing. Critics believe that it will lead to more people buying alcohol and cigarettes at departure airport duty-free and smuggling them into India without paying duties.

When asked what will they do if the Government places additional restrictions on duty-free purchases of sin goods like alcohol and cigarettes, 57% said they would have no option but to buy whatever the Government permits under the new rules. 27% said they would buy more of it from departure airports while 11% said they would buy from the local markets after paying respective duties and taxes.

57% citizens willing to comply if Government reduces limit on duty free purchase of sin goods

These restrictions, when they come into effect, will definitely benefit the Indian businesses as the consumption will shift from foreign products to Indian products. These rules which are being made by a group of various ministries in collaboration with the Bureau of Indian Standards will also ensure tighter controls on imports.

Indian manufacturers will hope that these new rules are announced in the upcoming budget and come into effect from 1st April 2020.

About LocalCircles

LocalCircles takes Social Media to the next level and makes it about Communities, Governance and Utility. It enables citizens to connect with communities for most aspects of urban daily life like Neighborhood, Constituency, City, Government, Causes, Interests and Needs, seek information/assistance when needed, come together for various initiatives and improve their urban daily life. LocalCircles is free for citizens and always will be!

Akshay Gupta - media@localcircles.com, +91-8585909866

All content in this report is a copyright of LocalCircles. Any reproduction or redistribution of the graphics or the data therein requires the LocalCircles logo to be carried along with it. In case any violation is observed LocalCircles reserves the right to take legal action.