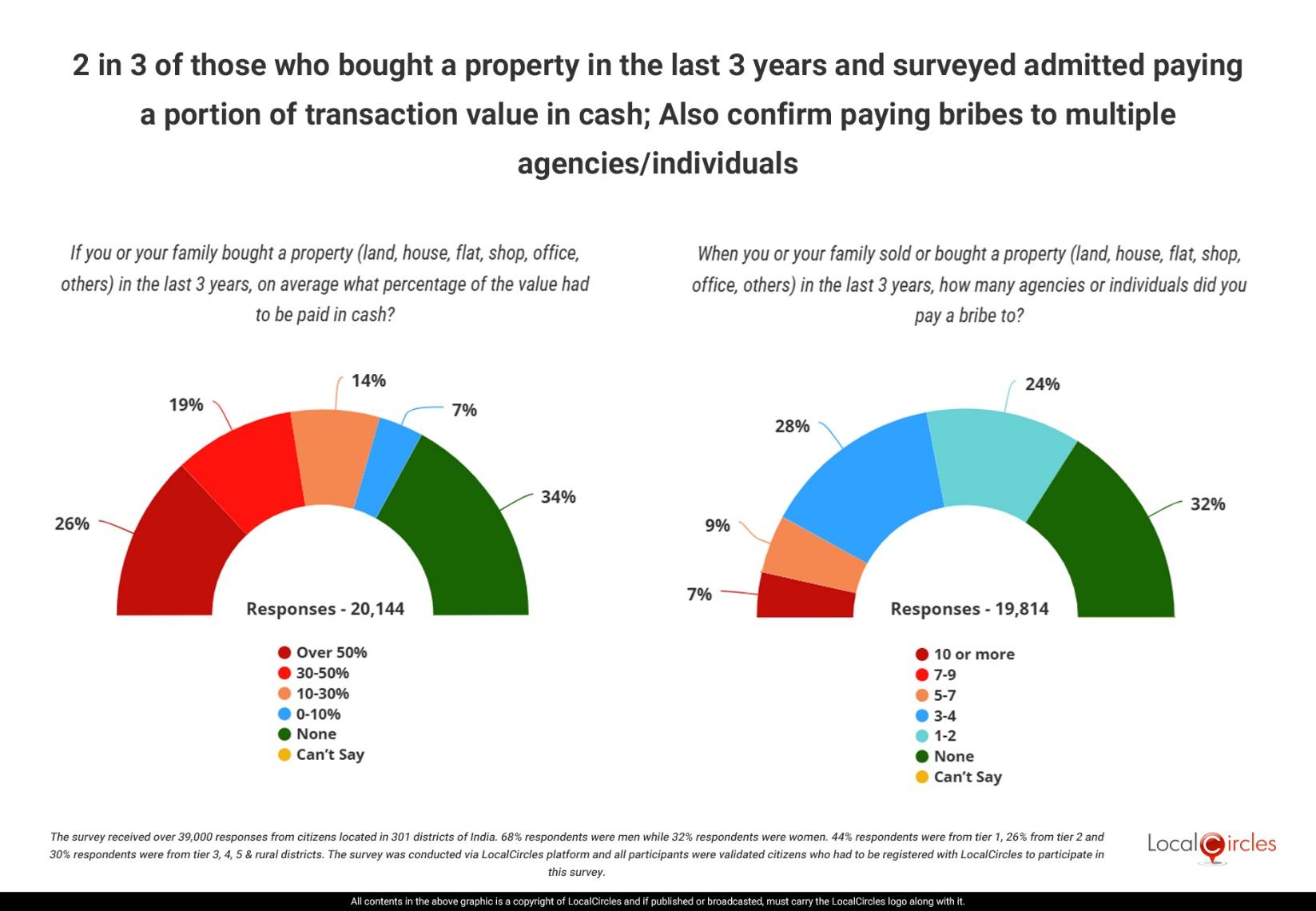

2 in 3 of those who bought a property in the last 3 years and surveyed admitted paying a portion of transaction value in cash; Also confirm paying bribes to multiple agencies/individuals

- ● 26% of those who bought a property paid over half of the amount in cash

- ● 44% of them paid a bribe to three or more agencies/individuals

November 8, 2025, New Delhi: Nine years after demonetization, the real estate sector in India remains heavily impacted by the presence of black money and corruption at various levels. This manifests in various ways, including inflated property prices, cash transactions to evade taxes, and a lack of transparency in deals.

Despite government initiatives to link Aadhaar with property for maintaining digitised records, promote transparency through digital payments and streamlining of the processes, black money still fuels the sector. Countering government policies, the process of buying and selling property remains intertwined with bureaucratic hurdles and high transaction taxes.

A recent interaction on the LocalCircles platform saw someone starting a discussion after her friend asked her to give INR 2 lakhs in cash to help buy a property. The friend had admitted that she had asked several people in her family and friends circle to do the same as she had to pay part of the transaction in black money. The incident raised the question of why salaried people are having to convert their tax paid money or legal income to black money for property purchase.

“Up to 50% of high-value property deals involve unreported cash, evading taxes and inflating prices,” states Dr Rakesh Verma, a former bureaucrat, in a policy paper “Addressing Inflated Real Estate Prices in India – Tackling Corruption, IAS Involvement, and the Role of Big 4 False Reports”, published on LinkedIn. Verma states that the regulatory inefficiencies like the need for 40–70 approvals create bottlenecks, thereby fostering corruption and increasing costs which are passed on to buyers.

The Indian real estate market saw a significant increase in land transactions in the first half of 2025, with deals worth INR 30,885 crore, according to ANAROCK Property Consultants. This surge in activity is attributed to a rise in both outright purchases and joint development agreements. Anarock reports that while the market has seen a reduction in the use of black money in housing deals since demonetization, with a decrease of 75-80%, it's still a factor in smaller towns and peri-urban areas.

Other studies and shared experiences of buyers in the cities, however, show that black money forms a major component of most property deals, especially in plots, resale deals, and where circle rates remain low vs actual price. Thus, it's common for buyers or sellers to conclude property transactions “off the books" in cash to avoid taxes, effectively creating black money. For example, a property officially registered for INR 70 lakh might have a total transaction value of INR 1 crore, with INR 30 lakh paid in cash. While the local authorities have fixed circle rates (minimum property value for registration) depending on the location, infrastructure and facilities available, the actual market rates are often much higher, which create opportunities for corruption to bridge the difference.

In the last 3 years, the number of survey operations by the Income Tax Department has declined. However, the average amount of undisclosed income detected per survey has increased significantly, suggesting a more targeted and intelligence-driven approach by the I-T department, Minister of State for Finance Pankaj Chaudhary informed the Rajya Sabha in August. During 2024–25 financial year, through 465 survey operations, the Income Tax (I-T) Department detected INR 30,444 crore in undisclosed income (black money), Chaudhary informed the Rajya Sabha in a written reply. In 2023-24, IT Department conducted 737 survey operations, which led to detection of INR 37,622 crore undisclosed income. In 2022-23, during 1,245 survey operations undisclosed income of INR 9,805 crore was detected. Apart from black money, all operations yielded considerable assets.

Through a new study LocalCircles has strived to find out if there has been any change in the last 3 years in the usage of black money in real estate. The survey received over 39,000 responses from citizens located in 301 districts of India. 68% respondents were men while 32% respondents were women. 44% respondents were from tier 1, 26% from tier 2 and 30% respondents were from tier 3, 4, 5 & rural districts.

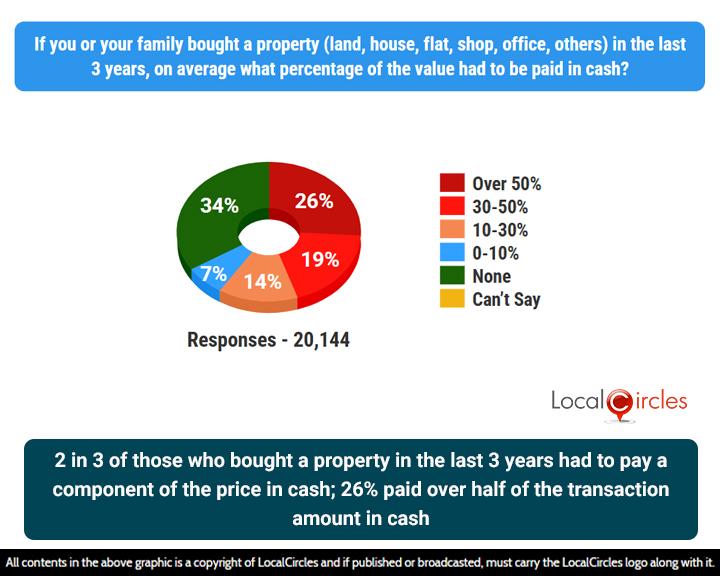

2 in 3 of those who bought a property in the last 3 years had to pay a component of the price in cash; 26% paid over half of the transaction amount in cash

The survey first asked, “If you or your family bought a property (land, house, flat, shop, office, others) in the last 3 years, on average what percentage of the value had to be paid in cash?” Of the 20,144 who responded to the question 26% stated they had paid “over 50%” in cash; 19% of respondents stated they had paid “30-50%” in cash; 14% of respondents stated they had paid “10-30%" in cash; 7% of respondents stated they had paid “0-10%” of the transaction in cash; only 34% of respondents stated they had paid “none” of the transaction in cash. In essence, 2 in 3 of those who bought a property in the last 3 years had to pay a component of the price in cash; 26% of them paid over half of the amount in cash.

The survey findings show how prevalent still is the use of cash in property transactions. While in the purchase of flats from a builder in a metro the use of cash may have decreased, it is still very much intact in land and plot transactions or those of old family properties. Any time someone is looking for a property, an early conversation between buyer and seller is coming to terms on the kachha-pakka or black-white ratio for the transaction.

Over 2 in 3 who paid a bribe during sale or purchase of a property in the last 3 year: 44% of them had to pay between 3-10 different agencies/individuals

To speed up the process of property sale complete with the documentation many people end up paying bribes to various officials mostly through middlemen with suitable contacts. The survey asked, “When you or your family sold or bought a property (land, house, flat, shop, office, others) in the last 3 years, how many agencies or individuals did you pay a bribe to?” Out of 19,814 who responded to the question 7% stated “10 or more” individuals/ agencies; 9% of respondents stated “7-9” individuals/ agencies; 28% of respondents stated "5-7” individuals/ agencies; 24% of respondents stated "3-4” individuals/ agencies; and 32% of respondents stated "none” had to be paid a bribe to complete the process. To sum up, 7 in 10 who paid a bribe during sale or purchase of a property in the last 3 years had to pay between 3-10 different agencies/individuals.

Real estate is the sector with the highest levels of bribery in terms of value where anyone conducting a transaction, even if by the book, ends up paying a bribe to get the file moving. From Patwari to revenue inspector in the local revenue or tehsil office to clerks, typists and deed writers in the sub registrar office to local municipality and land survey offices, any individual selling land has to provide gratification to many. Then there are the local politicians like village sarpanch or ward member who expect something, at times demand it. To handle all this, most individuals end up hiring a broker or a property consultant who facilitates the transaction or in other words bribes all these individuals/agencies.

To summarise, nine years after demonetisation, black money continues to be the unspoken currency driving India’s real estate sector. Despite digitisation drives, Aadhaar linkage, and efforts to curb corruption, the survey finds that cash transactions and bribes remain deeply entrenched. Two in three citizens who bought property in the last three years said they paid part of the amount in cash, with one in four admitting that more than half the deal was off the books.

Corruption too remains rampant — seven in ten respondents who paid a bribe said they had to deal with anywhere between three and ten officials or intermediaries to get their paperwork cleared. From tehsil offices to sub-registrars, and from municipal clerks to local politicians, the web of payoffs continues to thrive. Experts say the root cause lies in regulatory bottlenecks and in many cases, low circle rates, which create fertile ground for under-the-table dealings. While digital reforms and stricter tax monitoring have reduced cash use in new projects across metros, smaller towns and resale markets remain largely untouched. The findings underline a stark reality — real estate in India remains one of the least transparent sectors, where black money still finds a safe home.

Survey Demographics

The survey received over 39,000 responses from citizens located in 301 districts of India. 68% respondents were men while 32% respondents were women. 44% respondents were from tier 1, 26% from tier 2 and 30% respondents were from tier 3, 4, 5 & rural districts. The survey was conducted via LocalCircles platform, and all participants were validated citizens who had to be registered with LocalCircles to participate in this survey.

About LocalCircles

LocalCircles, India’s leading Community Social Media platform enables citizens and small businesses to escalate issues for policy and enforcement interventions and enables Government to make policies that are citizen and small business centric. LocalCircles is also India’s # 1 pollster on issues of governance, public and consumer interest. More about LocalCircles can be found on https://www.localcircles.com

For more queries - media@localcircles.com, +91-8585909866

All content in this report is a copyright of LocalCircles. Any reproduction or redistribution of the graphics or the data therein requires the LocalCircles logo to be carried along with it. In case any violation is observed LocalCircles reserves the right to take legal action.

Enter your email & mobile number and we will send you the instructions.

Note - The email can sometime gets delivered to the spam folder, so the instruction will be send to your mobile as well